It’s proving to be a tough year for South Africans on the money front what with the drought, the volatile Rand, rising food prices, petrol prices and interest rates. Given all these factors it’s not surprising that South Africans are searching for solutions online.

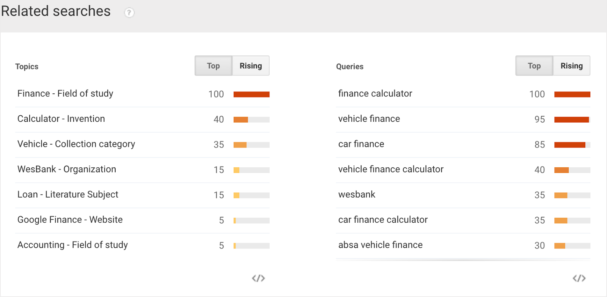

A look at Google search trends over the past 30 days shows a consistent interest in ‘finance’ as a general search term. Drill down into terms related to the main topic, and you’ll find rising interest in the terms ‘finance calculator’, ‘vehicle finance’ and ‘car finance’.

South Africans are looking to buy vehicles and want to know what they can afford to drive. While new and used vehicle sales continue to decline, for the first time since 2009, demand for used vehicles now outstrips new vehicles.

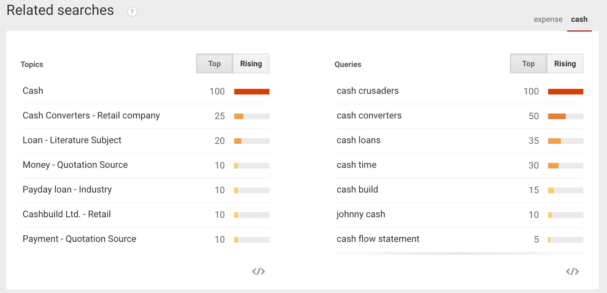

The recent interest rate hike (6.75% to 7%) also changed repayments for those with variable interest rates and made it more expensive for those wanting to take out a loan. Not surprisingly ‘cash’ is another hot topic.

TOP TIP: Just because money is tight, it doesn’t mean becoming a couch potato. With 6 budget fitness ideas, you can get fit without breaking the bank.

‘Cash’ receives consistent attention over time. The related search terms provide an interesting snapshot of what, financially, is on South Africa’s minds. People are looking for ways to get cash for their goods or at micro loans. With red meat prices expected to increase by 50%, petrol set to go up by 18 cents as well as another rate hike on the cards, South Africans are looking for ways to get cash now.

To save on costly life stage expenses, such as sending kids to varsity, follow these 9 tips.

This article was created using Google Trends by Google South Africa.