If you haven’t already noticed, handbag prices, especially those of designer bags, have sky-rocketed in recent times.

It’s not like all handbags were ever going to be exempt from inflation costs and exchange rate woes – factors that have seen numerous luxe products and everyday items shoot up shockingly around the world.

However, the handbag price hike is reaching points that’ll make you do a double take and it’s not just because of a volatile market.

Why do people pay so much for handbags in the first place?

In July this year, I read the story about a handbag that sold for a quarter of a million rand. Yes, it was a Birkin (a Hermés Fjord Leather Birkin to be precise, which was only a recipe for high-end costs) but I remember wondering who on Earth was coughing up what could be someone else’s home downpayment for a bag.

Don’t get me wrong, I understand the investment value of high fashion intricately, but even I had to wonder if the financial aspect of individual pieces had gone too far.

My raised eyebrows led me to investigate how fashion in 2022 will run with the recession we’re unofficially in.

Why designer bags continue to skyrocket in price

According to The Business of Fashion, brands have been slowly increasing their designer bag prices throughout the years – we’re just started to notice more now because even everything, including the price of air, feels like it’s gone up.

Per their data, something of a chain reaction has come about as high-end brands seek to align their prices with their competition. The brands we’re talking about here include the likes of Versace, Michael Kors and Jimmy Choo.

One goes up and the others follow – not unusual for the diamond walk of stores. For reference, in the US, designer bag costs have risen by 27 per cent since 2019. The striking difference however, is that prices seem to be going up a lot more, and the reason behind it is unsurprisingly inflation – but that’s not the only reason.

We can’t forget that these brands’ markets are high-net-worth individuals. And what do these kinds of earners do when inflation soars? They invest.

Some fashion experts predict that prices will continue to rise for luxe pieces like handbags due to the thinking that these super wealthy individuals won’t be as affected by the recession (should it officially come) and so they’ll refocus their target to the highest tier of the upper echelon with more exclusive and pricey releases instead of broadening their ranges for just the regular ‘wealthy’ Jane or John Doe.

Others emphasise that items like the mighty handbags are understood as “recession-proof assets’, which in short offers an “excuse” as to why the prices have increased as much as they have. They’re in higher demand because their value tends to go up.

One research report, compiled by Deloitte and Credit Suisse, shares that “handbags and watches fall into that category and can be classified as store of value assets with low risk, low volatility and mid-single-digit returns.” In simple terms, they’re part of what experts call inflation-protected assets.

A report by NY Post shared that the frenzy right now is focused on Chanel bags. The Deloitte and Credit Suisse data notes that these bags have risen by 25%, but the reason is because these bags offer the best “inflation protection.”

So, if your jaw drops the next time you face the price tag of a designer bag you’ve been drooling over for months, don’t feel guilty for making a purchase. It could just be your recession-saving grace.

ALSO SEE:

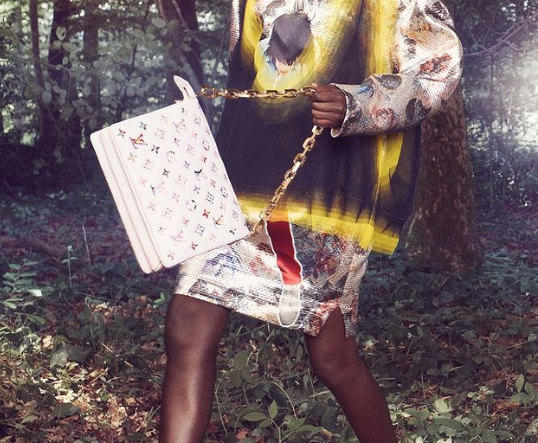

Feature Image: David Sims/Louis Vuitton